As we enter the new tax season, it’s important for individuals and businesses to stay updated on the latest forms and regulations. One form that has seen significant changes is the 1099-NEC. Previously, nonemployee compensation was reported on the 1099-MISC form, but starting from 2021, it has its own dedicated form.

Understanding the 1099-NEC

The 1099-NEC, which stands for Nonemployee Compensation, is used to report income earned by individuals who are not employees or regular staff members. This includes independent contractors, freelancers, and other self-employed individuals. The purpose of this form is to document and report the income received from these nonemployee sources.

The 1099-NEC, which stands for Nonemployee Compensation, is used to report income earned by individuals who are not employees or regular staff members. This includes independent contractors, freelancers, and other self-employed individuals. The purpose of this form is to document and report the income received from these nonemployee sources.

In the past, these payments were reported on the 1099-MISC form, which also included other types of payments such as rent, royalties, and awards. However, with the introduction of the 1099-NEC, the IRS aims to streamline the reporting process and provide greater clarity for taxpayers.

Changes and Implications

The separation of nonemployee compensation onto its own form has several implications. First and foremost, it simplifies the reporting process for both businesses and individuals. By having a dedicated form, it eliminates confusion and ensures that the income from nonemployee sources is reported accurately.

The separation of nonemployee compensation onto its own form has several implications. First and foremost, it simplifies the reporting process for both businesses and individuals. By having a dedicated form, it eliminates confusion and ensures that the income from nonemployee sources is reported accurately.

Another significant change is the deadline for filing the 1099-NEC. Unlike the 1099-MISC, which had a deadline of January 31st to provide recipients with a copy and to file with the IRS, the 1099-NEC has a filing deadline of January 31st for both paper and electronic filings. This makes it crucial for businesses to stay organized and meet the deadline to avoid penalties.

Filling Out the 1099-NEC

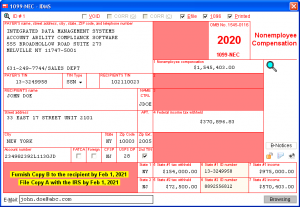

When filling out the 1099-NEC form, it’s important to gather all the necessary information. This includes the recipient’s name, address, taxpayer identification number (TIN), and the amount of compensation paid during the tax year. The form also requires the payer’s information, including their name, address, and TIN.

When filling out the 1099-NEC form, it’s important to gather all the necessary information. This includes the recipient’s name, address, taxpayer identification number (TIN), and the amount of compensation paid during the tax year. The form also requires the payer’s information, including their name, address, and TIN.

Once the form is completed, it must be delivered to the recipient by January 31st and filed with the IRS by the same deadline. Businesses can choose to file the form electronically or by mail, but electronic filing is generally recommended due to its efficiency and reduced processing time.

Benefits of Using the 1099-NEC

The introduction of the 1099-NEC offers several benefits for both businesses and individuals. For businesses, it provides a clear and separate form for reporting nonemployee compensation, eliminating any potential confusion when filing taxes. It also helps ensure compliance with IRS regulations and avoid penalties for incorrect reporting.

The introduction of the 1099-NEC offers several benefits for both businesses and individuals. For businesses, it provides a clear and separate form for reporting nonemployee compensation, eliminating any potential confusion when filing taxes. It also helps ensure compliance with IRS regulations and avoid penalties for incorrect reporting.

On the other hand, individuals who receive nonemployee compensation can benefit from the accurate reporting provided by the 1099-NEC. It helps them document their income properly and report it on their individual tax returns. By accurately reporting their income, individuals can avoid any discrepancies or issues with the IRS.

Conclusion

The introduction of the 1099-NEC form brings clarity and simplicity to the process of reporting nonemployee compensation. By separating it from the 1099-MISC, the IRS aims to streamline the reporting process and ensure accurate documentation of income. Businesses and individuals alike should familiarize themselves with the new form and its requirements to meet their tax obligations effectively.

Remember, tax laws and regulations may change frequently, so it’s always wise to consult with a tax professional or visit the official IRS website for the most up-to-date information.