If you’re looking for a practical way to manage your finances, look no further than the Dave Ramsey envelope system. This simple yet effective method has been embraced by millions of people around the world, helping them take control of their spending and save money. In this post, we’ll explore the concept of cash envelopes and how you can use them to budget your expenses and achieve your financial goals.

What is the Dave Ramsey envelope system?

The Dave Ramsey envelope system is a cash-based budgeting method that involves dividing your income into different categories and allocating a specific amount of cash for each category. Instead of relying on credit cards or debit cards, you use physical envelopes to store your cash for various expenses, such as groceries, transportation, entertainment, and more.

Having separate envelopes for each expense category allows you to visually see how much money you have left for each category and prevents overspending. Once you’ve allocated all your cash for a particular category, you can’t spend any more until the next budgeting period, which helps you stay within your means and avoid impulse purchases.

Having separate envelopes for each expense category allows you to visually see how much money you have left for each category and prevents overspending. Once you’ve allocated all your cash for a particular category, you can’t spend any more until the next budgeting period, which helps you stay within your means and avoid impulse purchases.

Why use cash envelopes?

There are several advantages to using cash envelopes for your budgeting:

1. Increased awareness: When you physically handle cash, you become more conscious of your spending habits. The act of taking money out of an envelope and seeing it diminish adds a layer of accountability to your purchases.

1. Increased awareness: When you physically handle cash, you become more conscious of your spending habits. The act of taking money out of an envelope and seeing it diminish adds a layer of accountability to your purchases.

2. Elimination of debt: By relying on cash instead of credit cards, you avoid the temptation of overspending and accumulating debt. Cash envelopes can help you break the cycle of living beyond your means and start building a solid financial foundation.

3. Improved organization: With cash envelopes, you have a clear visual representation of where your money is going. This eliminates the need for complicated spreadsheets or budgeting software and simplifies the budgeting process.

How to implement the envelope system?

How to implement the envelope system?

Implementing the envelope system is relatively straightforward:

1. Identify your spending categories: Begin by categorizing your expenses into different categories, such as groceries, transportation, dining out, entertainment, and so on. Determine the amount of money you want to allocate to each category based on your income and financial goals.

2. Get your envelopes: You can use simple envelopes or purchase pre-designed cash envelopes online. Alternatively, you can create your own DIY envelopes using colorful paper or cardstock.

3. Allocate cash to each envelope: Take the allocated amount of cash for each category and place it in the respective envelope. Write the category name on the envelope to easily identify its purpose.

4. Use the envelopes for your expenses: Whenever you make a purchase within a particular category, use the cash from the corresponding envelope. Once the envelope is empty, you know that you’ve reached your spending limit for that category.

4. Use the envelopes for your expenses: Whenever you make a purchase within a particular category, use the cash from the corresponding envelope. Once the envelope is empty, you know that you’ve reached your spending limit for that category.

5. Adjust as needed: As your financial situation changes, you may need to modify your budget and reallocate funds across different categories. The envelope system allows for flexibility and encourages regular evaluation of your spending habits.

Make budgeting fun and visually appealing

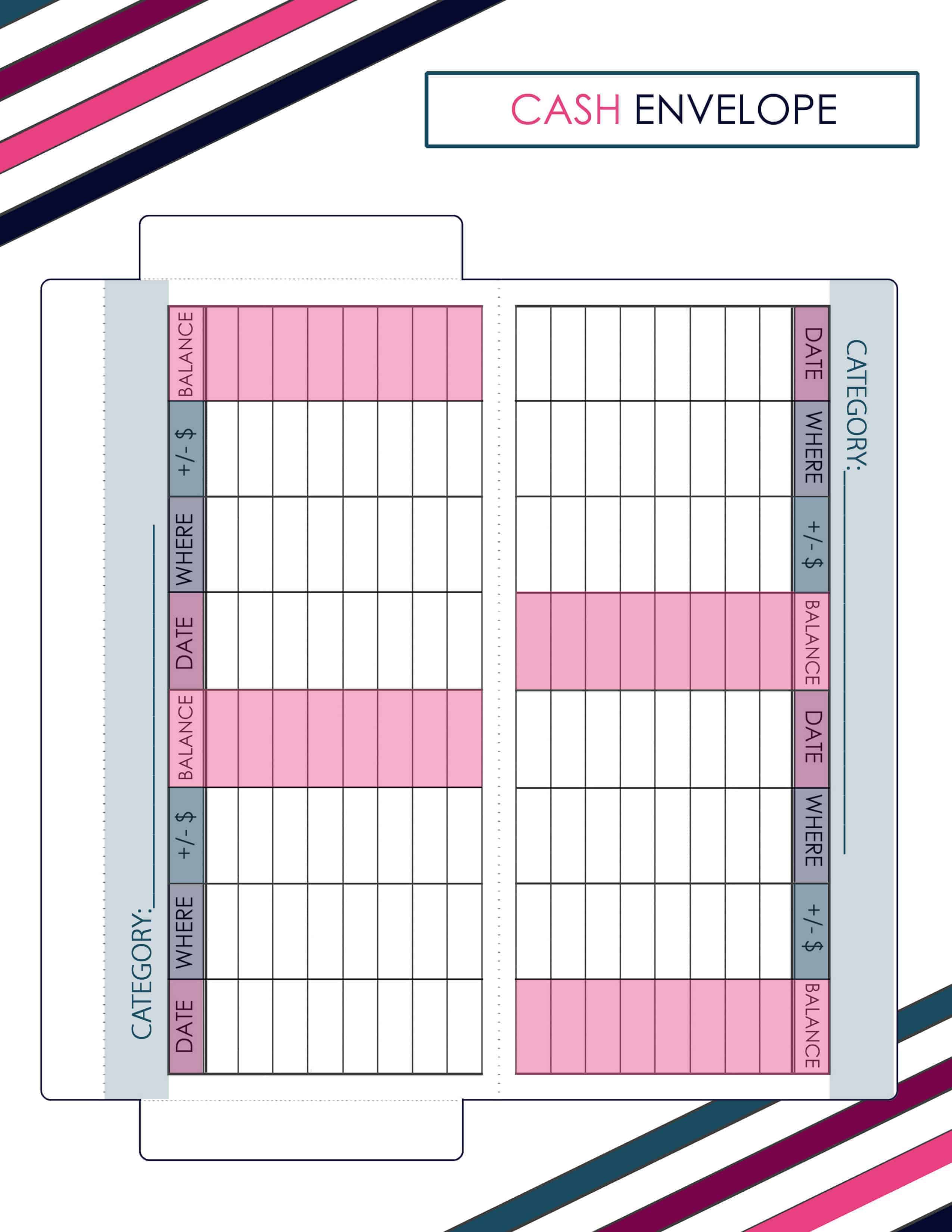

Budgeting doesn’t have to be a dull and mundane task. You can make it more enjoyable and visually appealing by using printable cash envelopes like the ones showcased below:

These printable cash envelope inserts are designed to fit perfectly in standard envelopes. They feature attractive designs and labels for different expense categories, adding a touch of creativity and personalization to your budgeting process.

These printable cash envelope inserts are designed to fit perfectly in standard envelopes. They feature attractive designs and labels for different expense categories, adding a touch of creativity and personalization to your budgeting process.

By using these printable cash envelopes, you can make budgeting an engaging and aesthetically pleasing activity. Plus, they can serve as a constant reminder of your financial goals and aspirations.

Conclusion

Conclusion

The Dave Ramsey envelope system provides a practical and tangible way to manage your finances effectively. By using physical cash envelopes for your budgeting, you gain greater awareness and control over your spending habits, leading to improved financial well-being. Remember, it’s essential to regularly assess and adjust your budget as your financial circumstances evolve. So why wait? Get started with the envelope system today and take a significant step towards achieving your financial goals.